rhode island state tax form

Affidavit of Gift of Motor Vehicle SU 87-65 PDF file less than 1mb. Download Complete Form RI-1040 residents or RI-1040-NR nonresidents and part-year residents for the appropriate Tax Year below.

Rhode Island Form 2290 Heavy Highway Vehicle Use Tax Return

Form RI-1040 - Individual Income tax Return.

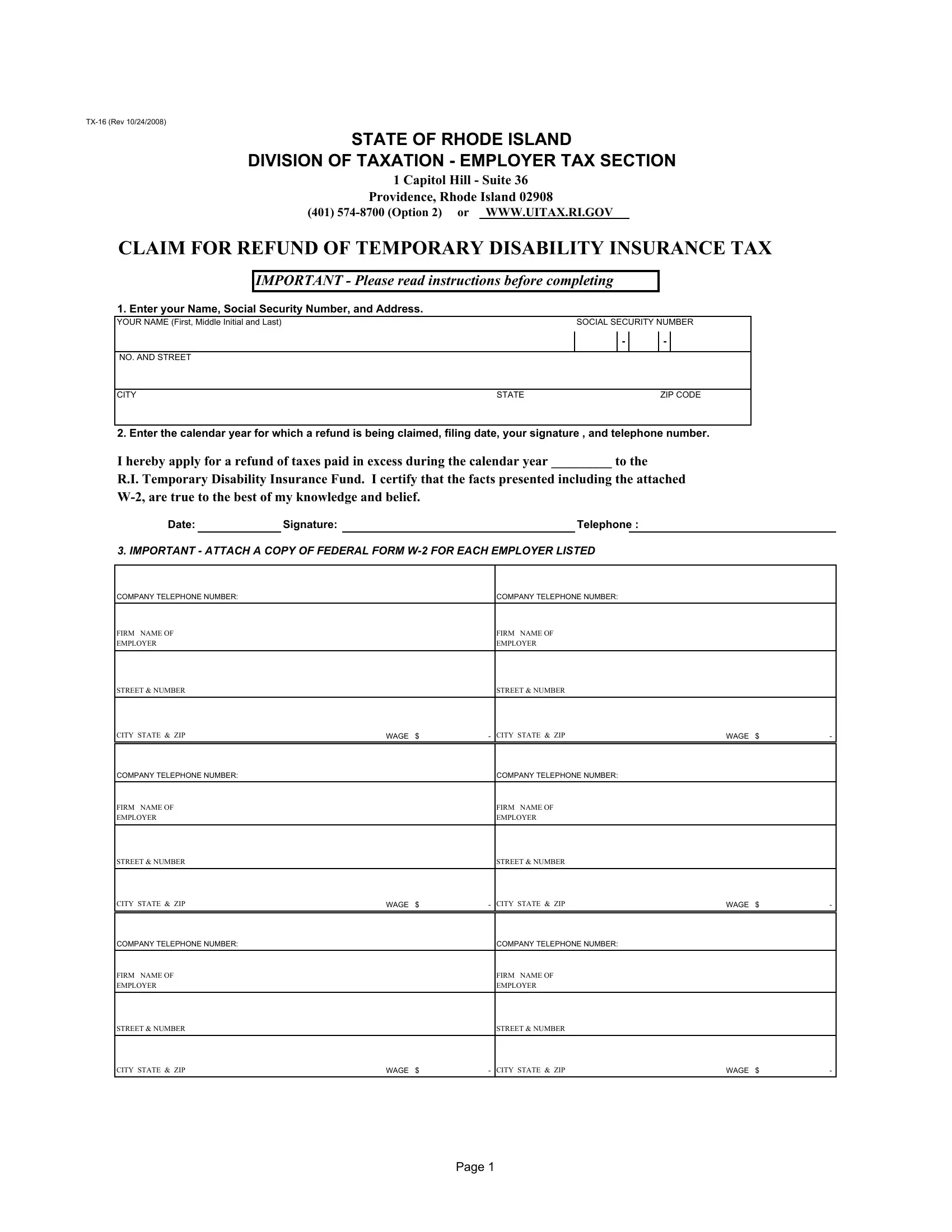

. Checklists and forms for common tasks such as new or used vehicle purchases plate changes re-registration or nameaddress changes provided by the DMV. RI Employer Tax Section 401-574-8700 Option 1 - unemployment and TDI. Sign Mail Form RI-1040 or RI-1040-NR to.

BAR PDF file less than 1 mb megabytes. Rhode Island State Income Tax Forms for Tax Year 2021 Jan. Form ESTATE-V Form ESTATE-V Estate Tax Payment Voucher Form PDF file less than.

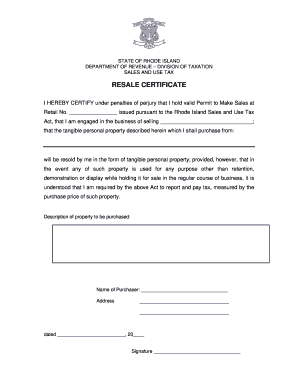

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. Application for Extension of Coverage to Exempt Workers Religious Organizations. RI Division of Taxation - 401-574-8829 - sales tax questions Do you need a permit to make sales at retail.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax. Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file less. The state income tax table can be found inside the Rhode Island.

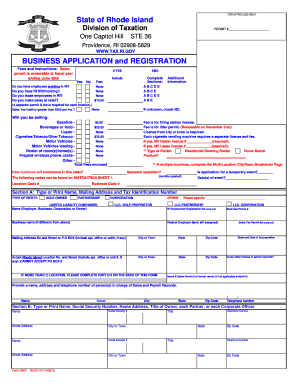

BAR Business Application and Registration PDF file less than 1mb. Form RI-4768 Form RI-4768 Estate Tax Extension Application PDF file less than 1mb. TaxFormFinder provides printable PDF.

New or used vehicles sales tax is 7 of the purchase price minus trade-in and other allowances. Refund for Appraisals Bills Mileage and Leased Vehicles C-REF-SU PDF file less than. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

RI-1040 can be eFiled or a paper copy can be filed via mail. Form RI-1040 is the general income tax return for Rhode Island residents. Business Application and Registration.

Rhode Island State Income Taxes for Tax Year 2021 January 1 - Dec. This applies to passenger vehicles and motor homes only. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Rhode Island has a state income tax that ranges between 375 and 599 which is administered by the Rhode Island Division of Taxation. Download Form PDF Add to a task list Rhode Island Film TV Motion Picture Production Tax Credit Initial Application Rhode Island State Council on the Arts - Rhode Island Film. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2 mb megabytes RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than.

Details on how to only. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Free Tax 2848 Power Of Attorney Forms

Filing Rhode Island State Taxes What To Know Credit Karma

Ri W4 Fill Online Printable Fillable Blank Pdffiller

Ri Resale Certificate Fill Out Tax Template Online

Rhode Island Notice Of Deficiency Letter Sample 1

Incorporate In Rhode Island Do Business The Right Way

Rhode Island State Tax Information Support

How To Register For A Sales Tax Permit In Rhode Island Taxvalet

Ri Form Bar 2015 2022 Fill Out Tax Template Online

State W 4 Form Detailed Withholding Forms By State Chart

Free Rhode Island Bill Of Sale Form Pdf Word Legaltemplates

Rhode Island State Tax Return Etax Com

Form 1040 Resident Resident Return Only

Where S My Refund Rhode Island H R Block

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Can I Deduct Any Unemployment Income On My Taxes Not In Rhode Island But You Can Deduct Some On Your Federal Taxes Newport Buzz